March 2025 – Vol. 14; Issue 1

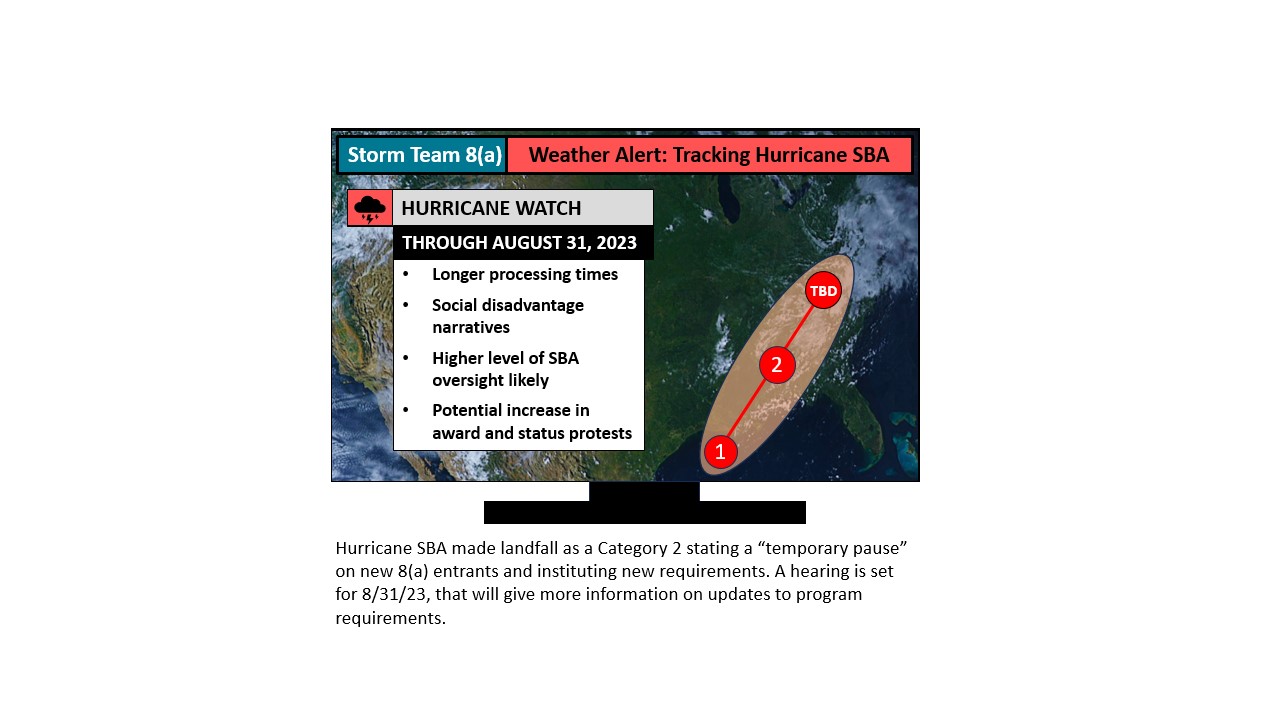

The Small Business Administration (SBA) concluded its winter meetings by publishing a final rule on December 17, 2024 “clarifying” the requirements around recertifying the size status of a contractor following an acquisition.