Tending the Campfire: Igniting the Flame of Market Intelligence

- Leveraging expert knowledge crosses the bridge from market research to market intelligence and will strengthen an organization’s ability to develop future growth opportunities

- Understanding and avoiding widely known market intelligence mistakes and following best practices will ensure organizations are utilizing the most relevant information and resources applicable to their goals

- Subject Matter Experts (SMEs) are the veteran guides used to navigate from market research to market intelligence, providing practical knowledge and giving additional meaning to information gathered

- Creating a “culture of market intelligence” supports an organizational commitment to ensuring data-driven and expertly informed decision-making

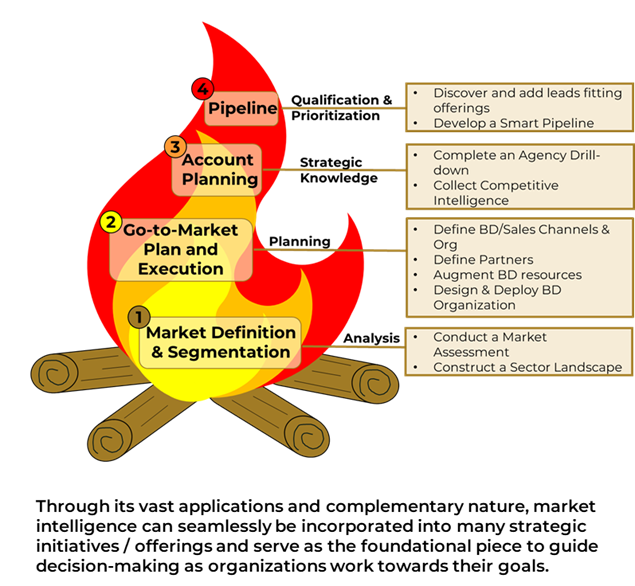

- Market intelligence serves as the foundation for broader strategies, providing key knowledge and clarity that can be used to identify bid opportunities and increase p(win)

- Intentionally using market intelligence can help organizations see beyond the federal market horizon, drive businesses forward, and reach your desired summit

Preparing for the Camping Adventure

The implementation of market intelligence on businesses has become a familiar tactic to improve numerous aspects of organizations. However, market intelligence needs to be properly planned for, just like a camping trip. Organizations need to beware of common market intelligence mistakes, as it can be easy to stray down the wrong trail. Common mistakes include only using one source, assuming inconsistencies to be trends, basing decisions on data alone, using out-of-date data, attempting to gather data at the last minute when it should be consistently tracked, and collecting information without an end result in mind. Learning and fully understanding what both market research and market intelligence are and the proper steps to take to be successful with market intelligence will prevent an organization from repeating known misconceptions. This will better position an organization for future operations, as forgetting your raincoat and running out of water are mistakes you will not make twice.

Navigating Market Intelligence

With the increased accessibility and ease of interpreting data, market research has become a standard practice and a growth-accelerator for an organization’s strategic decision-making. However, in the deep woods of today’s highly complex and competitive federal market, raw data and information alone will not keep you from going astray or missing your mark. Organizations need to not only plot the collection of data, but also evaluate, understand, and apply data outcomes in a way that is meaningful and tailored to a desired goal. Without these navigation skills, organizations may find themselves lost without a compass ‒ feeling overwhelmed and wasting hours wandering aimlessly through a dense forest of data, facts, and figures with no actionable results. Bearing the load of insights and analysis is what transforms market research into market intelligence, a differentiator for hiking through the federal market wilderness. The true trail guides of market intelligence are subject matter experts (SMEs), individuals with varying expertise who can read between the lines, pointing out the paths worth taking and providing crucial color and context to a vast landscape. Known as “the consultants of the consultants,” market intelligence SMEs leverage their expertise and industry knowledge to guide organizations on their path, bringing mundane quantitative data to life by providing a qualitative perspective and providing organizations with additional tools for using information.

Cooking up a Culture of Market Intelligence

While the benefits of market intelligence are vast, they are only felt when market intelligence is used organization-wide to complement other business offerings and drive company goals through data-driven, expert-informed decision-making. Too often, market intelligence gets left alone in the woods, finding itself delegated to a few individuals and disconnected from the larger organization. Operating in a vacuum such as this is not an effective use of market intelligence resources. Instead, market intelligence must be connected to all aspects of the broader business and guide strategic initiatives (e.g., key hires, mergers and acquisitions, etc.) and offerings. Companies must create and adopt a “culture of market intelligence,” ingraining the best practices and consistent utilization across business lines and into the very fiber of the organization. This culture fosters collaboration throughout the organization and ensures individuals from each line of business are aligned to the greater goals and targeted outcomes and allows for market intelligence SMEs to set appropriate parameters, acquire appropriate data, and provide expert knowledge to help move the organization forward.

Lighting the Campfire: Operationalizing Market Intelligence for GovCon Strategies

True market intelligence is much more than warmed-over empirical spending data, market sizing, and organization charts. When operationalized, market intelligence has a transcendent impact on strategy at the GovCon corporate, group, and bid opportunity level – delivering tangible value that informs and rationalizes decision-making. In the GovCon space, best practices include “Company X” blackhat role playing, “solution to win” analysis (not your grandparents’ outdated “how low can you go” price to win assessments) and ferreting out credible info on cure notices and award fees rather than relying on bloviations from competitors seeking to unseat incumbents. Useful market intel leverages non-obvious event correlation (e.g., business developer migration paths are a reliable early warning indicator of companies that are in trouble) to inform analysis, develop compelling win themes, and validate the tendentious rumors spread around the campfire. Well-run companies know that there is no true “white space” in the GovCon market. Market intelligence helps identify the sweet spot for any firm – the intersection of market attractiveness and the ability to compete. The best market intel doesn’t just confirm what you already knew…it unveils actionable insights you didn’t know to ask about.

10 Market Intelligence Elements That Can’t Be Ignored

- Informed, qualitative perspectives are as valuable as quantitative perspectives and providing professional input can assist in avoiding group think and internal echo chambers.

- Establishing specific objectives and ensuring everyone understands them is a primary imperative.

- Understanding an organization’s capabilities, customers, and structure is necessary to identify the right data sets.

- The market lacks one authoritative source of intel, making the crucial discipline the ability to seek out various sources, federate the data, and then interpret the ground truth through triangulation.

- The ideas, messages, and value propositions resulting from market intel need to be tested and validated.

- Even the most compelling value proposition requires knowing if someone is willing (or able) to change—more-so for mission-focused customers!

- When your capabilities help customers get things done (tangibly, and intangibly), it sells itself.

- Even the best solution still must conform to the constraints of the market; and always assume there are others trumpeting similar features and benefits.

- Understanding competitor strengths and weaknesses is key; but knowing why a customer is bound to a company is more valuable.

- There is nothing of greater benefit than having talent that not only can collect and interpret data from an analytical standpoint, but also provide practical, objective perspectives.

Ted Milone

202-744-1363

Ted.Milone@dwpassociates.com

Meredith Aurora

703-362-7737

Meredith.Aurora@dwpassociates.com

Jessica Butturff

703-786-1841

Jessica.Butturff@dwpassociates.com