Tracking Federal M&A’s Fall Foliage

- Along with the incoming vibrant foliage and brisk temperatures of the fall, federal M&A activity may have its own peaks with PE financing while feeling the cooler temperatures of uncertainty around FY24 funding and tighter budgets

- Following our March Practitioner’s Perspective, which featured a forecast for 2023 federal M&A activity, we are closing out the government fiscal year by recapping our predictions and comparing them to deal count data

- The buy-side continues to be driven by PE and PE-backed firms and in-demand tech talent, with buyers feeling warmer towards F&O business and opting to avoid majority-SBSA companies

- Procurement delays are leaving some sellers out in the cold, while a tighter market makes a frosty forecast for “story” companies

- Leaf peepers may be able to spot peak foliage for mid-tier acquisitions this autumn

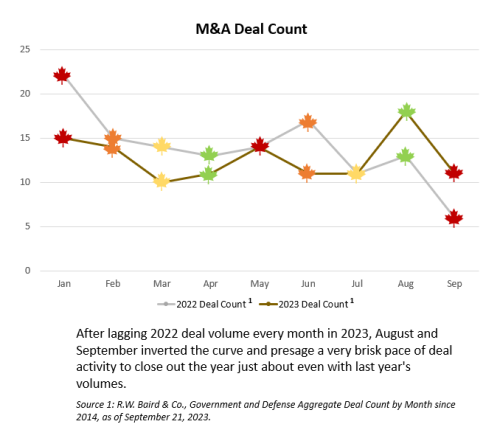

- While M&A activity has cooled down 2023 YTD compared to the same period in 2022, we expect the leaves to turn with increased volumes through the end of the year

The Turn of the Season

DWPA forecasted 2023 federal M&A activity in the March Practitioner’s Perspective. Now, as we enter the fall season and the government fiscal new year, it is time to reflect on the 2023 M&A atmosphere thus far and put on our weathermen hats again. In March, we forecasted that capital markets, private equity activity, technology trends, strategic acquirer activity, and a troubled geopolitical climate would stimulate more M&A activity. Conversely, we projected that higher interest rates and a looming debt ceiling, paired with procurement trends emphasizing Small Business Set-Asides, would cool deal volumes slightly. Heading into the final three months of the year, most – but not all – of our predictions hold true. Overall, transaction volumes were initially cooler than anticipated, with data showing a 21% decrease in closed transactions in the first half of 2023, as compared to the first half of 2022.

Buyers to Face the Cold

As temperatures drop, uncertainty looms over continued risk of a government shutdown and another interest rate hike, we expect buyers, particularly PE and PE-backed firms, to remain active in the market. As of March, we expected legacy consulting firms to remain the most aggressive buyers of scarce/in-demand capabilities to augment their existing federal IT portfolios. However, private equity (funds investing in platforms as well as acquisitions for platforms companies) has constituted the majority of deals closed in 2022 and continues to extend that lead in 2023. We also expected buyer strategy to be split between paying up for F&O businesses and stacking a few highly differentiated small businesses. This forecast was accurate, as many buyers are not willing to take on the risk of majority Small Business Set-Aside work. The hottest commodities have not shifted much since our last forecast—think DevSecOps, AI/ML, Low/No-code, and Cloud as the primary buzzwords, with bonus points for Cyber or Intelligence.

Select Sellers to Stay Warm Indoors

Less than favorable economic conditions (debt ceiling uncertainty, turbulent credit market dynamics marked by regional bank failures, etc.) have generally not deterred sellers from coming to market by any significant margin. However, select businesses will likely elect to stay indoors this winter. As for small businesses, the OMB’s increase in the small business revenue threshold size has already disincentivized SB owners from wanting to sell, as expected. As for 8(a)s, we do not expect the recently enacted social disadvantage narrative requirement to have any tangible impact on M&A activity, although 8(a)s that must submit new certifications will demand more due diligence from prospective acquirers. Generally, “story” companies that are not obviously attractive assets will be highly scrutinized in a tighter market and will likely wait a few years before trying the market. At a macro level, the chilling effect of procurement delays will continue to be felt – likely more by would-be sellers than buyers, as companies banking on that one recompete continue to wait out the cold.

Vibrant M&A Volumes to Come

We expect M&A foliage to become more vibrant through the end of the year. Specifically, we predict peak foliage for actionable mid-major assets in the market. We expect a resurgence in mid-tier acquisitions by PE platforms to keep warm through the winter. The historic trend of sizable, high-profile deals in recent years and the shortage of mid-tier contractors gives way to an increased appetite for mid-major assets for an autumnal cornucopia. Further, we expect continued PE and PE-backed platform interest in acquisitions through the end of the year. We also anticipate continued emphasis on cybersecurity and intelligence procurements into the new year. Finally, we will be avid leaf peepers when it comes to watching for a potential government shutdown and any impact on deal flow – could the government really move towards tighter budgets after 5+ years of good spending? We’ll continue to monitor the landscape.

Top 10 Drivers of M&A Activity in 2H23

- PE interest accounts for the majority of closed transactions

- Scarcity of actionable mid-tier targets causing many buyers to reach for earlier stage targets

- Interest rate uncertainty impacting total leverage far more than valuation

- Sellers willing to take increased structure to prop up multiples

- Pivot away from the War on Terror toward peer competition with China and Russia

- Concern with tighter federal budgets after 5+ years of good spending enticing those that can come to market

- Procurement delays causing those waiting on recompetes or major new business awards to have to stay on the sidelines

- Insatiable demand for scarce technical capabilities around cyber, DevSecOps, AI/ML, autonomy, etc.

- Looming election uncertainty and choppy debt markets make mega deals hard to execute

- Foreign buyers experiencing renewed interest in gaining exposure to the world’s largest defense budgets via M&A

Marty Brennan

703-587-7454

marty.brennan@dwpassociates.com

Charlotte Brewer

404-858-6974

charlotte.brewer@dwpassociates.com

Shera Bhala

410-544-5254

shera.bhala@dwpassociates.com