Braving the Winter: What You Can Do to Prepare for a Sale

- Timing the market is a mistake; focus on the fact that great companies are bought in any market and worry less about mean multiples

- Buyers and sellers can both have unrealistic valuation expectations – sellers, show buyers your worth via sustainable growth & profitability

- Keep up your firm’s reputation by maintaining strong customer relationships and differentiated solutions – those are priceless to buyers

- Don’t overlook the details – collect and organize your corporate and contract documents via a data room for ease of sharing with buyers

- Find ways to protect key employees in a change of control – incentive plans or restrictive stock options are common retention practices

- Engage third party advisors to provide real-time insights into buyer universe and valuation and structuring trends, and to tailor your process

Walking into the Tundra

Is it time to put the ski lodge on the market, place the cold gear in permanent storage, and move somewhere where January means golf and swimming pools? As we step forward into the unknown tundra of 2023, sellers wonder – did they miss the window? High interest rates, historic inflation, and general economic uncertainty are not often coupled with the seller-friendly environment we experienced in recent years. However, just as weathermen often fail to predict the next snow, we wouldn’t recommend trying to “time the market” as an exit strategy. Timing the market can result in missed opportunities (market can always get worse), and a failure to focus on what really drives enterprise value – growth. Remember, great companies get bought in any market, so keep tending your fire until you feel ready.

Bundle Up Before Heading Out

Before driving out into the M&A process snowstorm, make sure you conduct critical internal and external diligence checks. You’ll want to develop strategies to inform your customers about a potential acquisition and reference checks to avoid a slippery surprise. Consider engaging advisory firms (investment banks, auditors, consultants, QoE providers) early to make sure you don’t slip on the icy roads of your M&A journey. Sellers, be prepared for buyers to fully peel back your firm’s corporate layers, checking for any red flags before leaving town. Ensure any compensation, succession plans, and/or legal issues are not forgotten in hibernation, as buyers will be on the prowl. Just as you wouldn’t drive into a snowstorm without provisions, be sure to stock a data room with all contract files and corporate information. Finally, be ready to back up your sales pitch with data to avoid buyers getting cold feet on the deal.

Time to Check the Thermostat: When Should You Sell?

Are you about to graduate from small business and feel you don’t have the right leadership to succeed in a F&O environment? Do you feel you won’t be able to succeed in your current market at your current size? Do you think your enterprise value can only increase through significant or risky investments? If yes to any of the above, then it might be time to throw on that Canada Goose jacket and clear the snowy driveway for a sale. Make sure to consistently shovel your driveway as the snow piles up. This will prevent savvy buyers plowing you in for your lack of preparation. Year-round, you should focus on hiring employees, creating enduring offerings, developing a strong 8(a)/SB graduation strategy, and growing your business. These investments will pay off come springtime, boosting your firm’s valuation.

Hire Experts to Guide You Down M&A Slopes

You may not want to hit the slopes without an instructor. You’ve made the decision to go to market but aren’t sure how to identify and select the right buyer. Let an investment bank be your guide as they have a deep understanding of the buyer universe. Hire an investment bank to help maximize purchase price, or if you aren’t certain which potential buyers “have” to own you. Bringing in third party experts will also enable you to focus more on your core business and go tackle those black diamonds. Advisors, like ski instructors, are expensive, so weigh the pros and cons before deciding. In addition to making sure there is a personality fit, make sure they can tailor their approach to your desired outcome. Whatever ski trail you chose, finding the right buyer takes time and effort, but understanding your corporate objectives is key to making it down the mountain and avoiding any potential “yardsale.”

Defrosting Federal M&A Myths

- Myth: You can time the market

- Reality: It’s nearly impossible to find the “right time” to sell; focus on growth potential, owners’ personal goals, and the enduring value drivers

- Myth: Buying a company with prime positions on large IDIQs and GWACs guarantees more revenue

- Reality: The nature of most IDIQs and GWACs requires secondary competition and only guarantees the right to bid for certain work

- Myth: Obvious competitors = right buyers

- Reality: Competitors may not pay top dollar for you and the ultimate buyer is often outside your market and looking to expand its offerings

- Myth: There is always a premium for scale

- Reality: The drivers of premium valuations are also the traits that enable companies to achieve scale

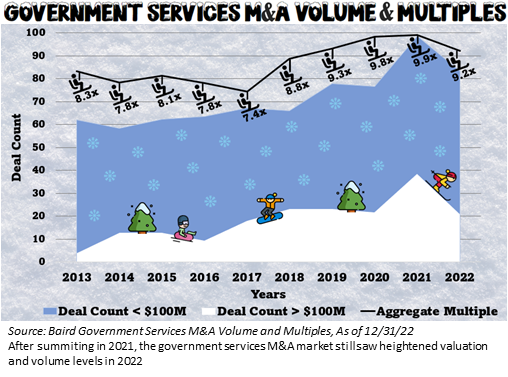

- Myth: M&A activity dramatically slows as interest rates rise

- Reality: GovCon stability and buyer “flight to quality” buffer M&A volumes and valuations even as interest rates rise

Will Halloran

203-585-4577

will.halloran@wolfdenassociates.com

Billy Marrin

703-244-9231

billy.marrin@wolfdenassociates.com

Kelly Moore

757-510-1111

kelly.moore@wolfdenassociates.com