The Big Dance Returns: 2023 Federal M&A Bracket

- In 2023, we expect fans to continue to view public, high-seed ADG teams as good defensive positions

- M&A efforts will focus initially on critical capabilities and customer presence, with contract vehicles becoming important later in the year

- We predict more teams, particularly publicly-traded buyers, will turn to the M&A transfer portal to supplement 2023 performance

- Increased investment in small businesses will likely disincentivize those players at the margin from entering the NBA in 2023

- The lack of mid-tier teams will split PE betting between F&O blue bloods and SBSA Cinderellas

- Investors will pay up for increasingly scarce top seeded teams and then dollar-cost average via lower seeded bolt-ons and tuck-ins

Analyzing Our 2022 Bracket

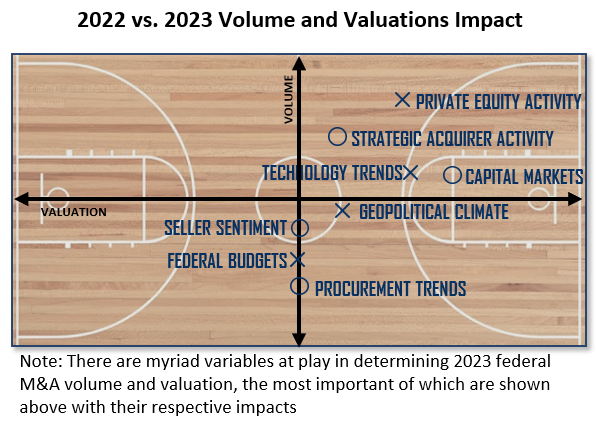

Grab your pen and paper and crack open a cold one: it’s time to fill out the 2023 federal M&A March Madness bracket. Unlike most professional “Bracketologists,” let’s reflect on what we got right and wrong in 2022. We correctly predicted strong recruiting for the hottest talent (AI/ML, Cyber, Cloud), which is likely to hold steady. However, this year we expect M&A efforts to focus on critical vehicles over capabilities or customers. As NCAA TV contracts end and key recompetes loom, teams will be looking for deals to join big money BIC/IDIQ conferences (e.g., Alliant 3, OASIS+, CIO-SP4). We incorrectly predicted lower public company valuations as recessionary fears drove investors to the security of ADG stocks, pushing these shares to close 2022 at or above 2021 price levels.

M&A Transfer Portal

Beyond acquiring critical contract vehicles, we expect strategic acquirers to turn to the M&A transfer portal to obtain strong players to pull growth forward into 2023, rather than disappointing boosters. Legacy consulting firms remain the most aggressive recruiters of scarce/in-demand capabilities to enhance their federal IT roster. We also expect international players to work their ways onto U.S. rosters, as geopolitical concerns drive the desire to increase exposure to the world’s largest defense budget. While the M&A transfer portal peaked in 2021, there continues to be high activity consistent with previous years. However, remember that the NCAA likes fair competition. Power conference teams should be aware that they are being scrutinized for any potential recruiting (antitrust) violations, which could lead to severe penalties for those who aren’t closely following the rules.

Delayed Graduation to the Big Leagues

Extended eligibility for small businesses will likely increase future draft stock and disincentivize would-be sellers from entering the draft early. Now that the NIL offers players endorsement opportunities and the government provides heightened SBSA ceilings, small businesses are incentivized to stick around for an extra year or two. In 2023, we predict would-be sellers to delay coming to market for another year to maximize their NBA draft stock. As small businesses gain more playing experience in the form of past performances, and as they mitigate small business transition risk, their draft stock will increase with investors. Additionally, a split Congress is unlikely to pass any tax changes, which in former years would have sent sellers rushing into the draft prematurely.

PE Bracketology

Given the lack of actionable mid-major (>$100M) assets, we predict private equity brackets to be bifurcated between paying premiums for less risky, F&O “blue blood” teams or picking several lower-seed SBSAs to outperform their peers in the tournament challenge. In strict “Calcutta” terms, investors can spend the same money to get the #1 seed or get all four #9 seeds. Neither strategy guarantees success, though private equity owners must be cognizant of the SBA’s affiliation rules when betting on a confederation of small business teams, as they might ultimately face a tougher draw than anticipated. This year, we expect private equity funds to continue to pay up for their initial entry into the bracket – especially for those scarce nine-figure platforms – and then dollar-cost average their investment through bolt-on and tuck-in acquisitions to craft a winning bracket.

Top Questions Facing the 2023 Federal M&A Court

- When will dim budget prospects post-2024 dampen M&A activity?

- Will tribally owned teams continue to be aggressive recruiters?

- Will understaffed and underperforming procurement teams across the board slow down awards and delay supply of sellers?

- When might the public/private valuation curve invert again in the federal sector?

- Will interest rates stabilize and even recede as the economy cools in 2H23?

- Can decreased supply of good candidates increase transaction multiples in 2023?

- At what point will the combination of budget pressures and higher interest rates negatively impact valuations?

- We may have seen the end of SPAC recruits, but when will the activist shareholders descend?

- Are there any pending system shocks – banking confidence, looming debt ceiling showdown – which will upset everyone’s tournament brackets?

Marty Brennan

703-587-7454

Marty.Brennan@deepwaterpoint.com

Charlotte Brewer

404-858-6974

Charlotte.Brewer@deepwaterpoint.com

Kevin Robbins

202-841-1085

Kevin.Robbins@deepwaterpoint.com