New Ruling from the Commissioner’s Office

The Small Business Administration (SBA) concluded its winter meetings by publishing a final rule on December 17, 2024 “clarifying” the requirements around recertifying the size status of a contractor following an acquisition. This has implications for companies holding certain set-aside Multiple Award Contracts (MACs) who are considering an exit in the future. Similar to NFL team owners lobbying the rules committee to forestall a shift in competitive dynamics, efforts by the GovCon community to sway SBA fell flat, forcing them to adapt to the new reality. Now, they must evaluate their game plan or risk elimination from playoff contention.

There is a one-year delay before this rule takes effect to allow time for the industry to plan for this change. Starting in January 2026, the new SBA ruling will reduce the long-term value of some MAC set-aside vehicles, decreasing overall firm valuations and increasing the risk for investors and businesses who previously relied on these MACs for extending the transition timeline. Much like any good football team gets its “capologist” and scouting team to read up on new rules, the industry needs to go to its draft board and scrub its strategy to determine whether they are positioned to stay the course, go to the draft board for a rebuild, or look for a deal before the January 2026 trading deadline.

Rules Committee Report

The SBA reemphasized that the sale of a contractor triggers a recertification process assessing whether the company continues to qualify post-close for set-aside status based on size or other disadvantaged status (e.g., 8(a), Service-Disabled Veteran-Owned Small Business (SDVOSB). If it does not, the company will receive a “disqualifying recertification.” While that is nothing new, the rule removes any discretion for contracting shops to retain the flexibility under certain vehicles to allow companies to maintain eligibility for the award of vehicle options and new task orders. Unrestricted MACs and single-award Blanket Purchase Agreements (BPAs) remain unaffected by this new ruling. It is important to note that the new clarification only impacts certain MACs, as 8(a) vehicles and some other Governmentwide Acquisition Contracts (GWACs) already have clauses in place to disqualify a company once an acquisition takes place.

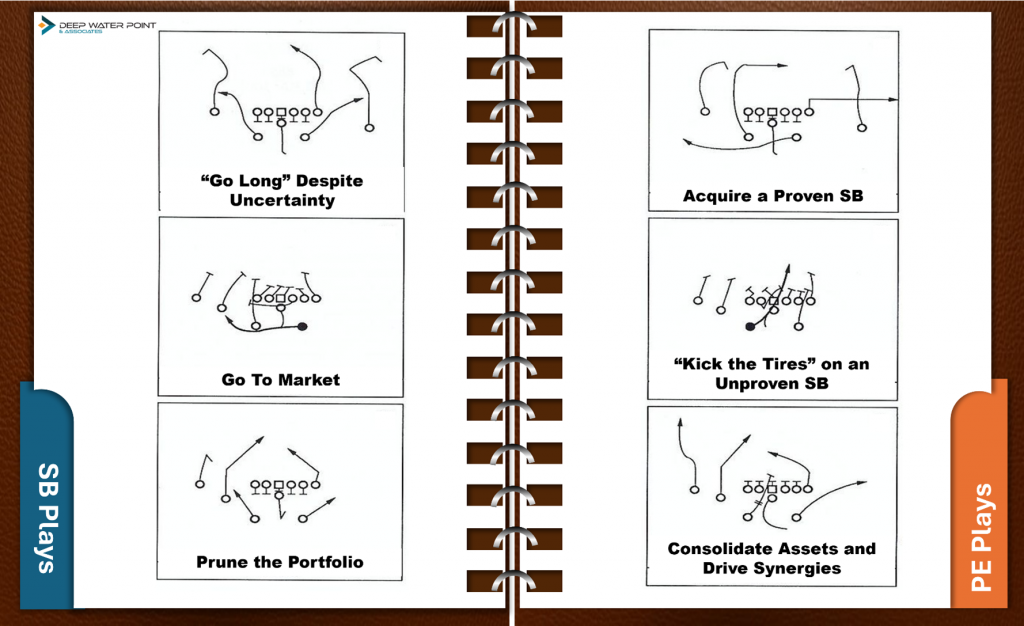

What does this mean for a small business? Well, if your playbook was to win a spot on a set-aside MAC, win a few task orders and exit by offering strategics, Private Equity (PE) firms, or PE-backed platforms backlog and several years of an attractive vehicle runway (the “Statue of Liberty” play), it’s time to go call a timeout, huddle-up and draw up some new plays.

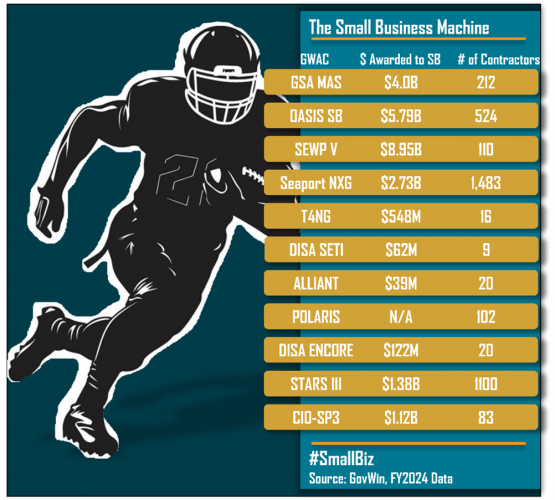

This graphic shows the dollar value awarded to small businesses

and the number of awardees on each vehicle in FY24.

Off-Season Overhaul: Rebuild, Reload, or Sell the Franchise

There are several reasons a small business may choose not to sell, regardless of where it stands in the small business cycle. If the business is confident in its ability to compete in the full-and-open market, then it should look to invest internally to expand its capabilities or its business development engine. If the business is not yet competitive but believes it can restructure its portfolio to succeed in the full-and-open market, it may need a new growth strategy targeting new customers, contracts and capabilities, and a refreshed pipeline to support such activities. Think of this as an NFL team having a young quarterback (QB) that is either already a complete product, primed for success, or a raw and unrefined QB that has the tools to become successful with a bit of guidance.

Teams would not want to trade these players before they reach their full potential as they could either keep them to bolster their own team or trade them later for greater value. Alternatively, the business might look to acquire a targeted tuck-in or merge with another business to accelerate scale and close gaps. And it might be able to take advantage of a loophole called out by the SBA, which allows for two small businesses to combine and not trigger a disqualifying certification of their respective set-aside MAC contracts. Lastly, timing plays a crucial role—if the business was not already preparing for a sale in the next 12+ months, finalizing a deal on short notice may prove to be difficult; the January 2026 trade deadline is closer than you think.

Conversely, a small business or a large with set-aside exposure might consider selling for a few reasons. First, it might be the right time; you have a good story to tell, you have your key recompetes behind you, you’ve locked in your advisors, and you have a timetable to exit in the next 12 months. If that’s the case, don’t dawdle, but go full steam ahead.

Second, a company might lack confidence in its current capabilities and does not believe it can successfully adapt to compete in the full-and-open market. Valuations are currently high compared to growth rates, which may make this an opportune moment for businesses looking to exit. It’s like an owner recognizing his franchise doesn’t have the right pieces to compete against the top teams in the league, and rather than face a losing season, the owner decides to sell the franchise while the market is hot, cashing out on the team before their value starts to decline.

Third, an alternative to selling the business might be to consider selling underperforming or underutilized contract vehicles. Selling government contract vehicles can be challenging and time consuming. The government contracting officer must approve a novation agreement, transferring contract obligations to a new entity, meaning businesses cannot assume a sale will be approved. In contrast, equity purchases—where an entire company is acquired—do not require novation, making them a more straightforward path to transferring contract vehicles. For small businesses struggling to generate new business under certain vehicles, monetizing an underperforming asset by selling it—if possible—is better than letting it remain idle. This delivers value now and frees up cap space around your strategy allowing you to focus on more productive paths. It’s better to trade a player sitting on your bench, and get something in return for them, rather than have them take up valuable space on the roster.

Scouting Reports Matter Now More Than Ever for PE Firms

The new SBA recertification rules introduce additional risks for PE firms investing in small businesses or those who are in the midst of a transition to full-and-open, particularly ones who in the past might have paid a higher turn for a business that had several years left on a sought-after MAC vehicle. Investors will need to assess whether the business can compete in the full-and-open market right away, without the runway it might have had under the prior rule interpretation. NFL owners are still willing to pay top dollar for a premier free agent with a proven track record but will likely use a more cautious approach when signing an undrafted free agent. That could lead to more cautious underwriting, potentially causing busted deals due to discrepancies over perceived value between buyers and sellers. Deals will always get done at premium pricing with good companies coming to market that have fully transitioned or shown a strong track record with progressing along that path. However, for those that haven’t gotten over the hump or don’t have the right go-forward vehicles, buyers may pass or reduce their cap hit with back-end loaded/structured/incentive-laden deals versus earnest cash at signing. As buyers and sellers struggle to align on valuations, the number of failed or delayed transactions is likely to rise, resulting in PE firms taking a more cautious approach to small business acquisitions, leaving more “free agents” unsigned.

Zach Senders

(301) 648-4644

zach.senders@dwpassociates.com

Marty Brennan

(703) 587-7454

marty.brennan@dwpassociates.com

Kevin Robbins

(202) 841-1085

kevin.robbins@dwpassociates.com